This is the first blog post in a series of posts that will discuss the economic theory of electrical equipment. A basic understanding of economic and electrical engineering concepts is recommended.

In a nutshell, an electrical transformer (not the Autobot type) is a device that transfers electrical energy from one circuit to another. This is accomplished with a change in voltage between the circuits connected to the transformer. Transformers are critical pieces of electrical equipment that are important in the distribution of electric power.

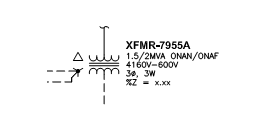

A typical transformer in a Single Line Diagram will look like this:

4160V/600V Transformer

This is a 2-winding delta-wye, three phase, liquid-filled, air cooled step-down transformer. The voltage rating on the primary side of this transformer is 4160V and on the secondary is 600V. Connected downstream of this transformer you can have motors, heat trace panels, lighting panels, UPS’, and even more transformers.

What will be the cost if this transformer were to fail?

The number of failures per year for a liquid-filled transformer is 0.0041 (IEEE standard 4931) times per year. In other words, 244 years per failure = 1/0.0041. For a liquid-filled transformer the Mean Time To Repair (MTTR) is 387 hours (IEEE standard 4931) whereas the Mean Time To Replace (MTTR) is 73.4 hours (IEEE standard 4931).

Let’s now look into the financial implications if the transformer were to fail:

The average spot price of WTI crude oil from June 28, 2013 to June 27, 2014 was $101.323 per barrel (Quandl2). The cost to produce a barrel of oil using non-conventional methods, in this case Steam Assisted Gravity Drainage (SAGD), is USD$63.50 per barrel (Scotiabank3). The USD to CAD exchange rate averaged to USD$1.0000 = CAD$1.0700 during June 28, 2013 to June 27, 2014 (Oanda4). Therefore, we will assume that the cost to produce one barrel of oil in Alberta using SAGD is CAD$67.945 = USD$63.50 * $1.0700 CAD/USD.

Other assumptions that we will also make, include:

- Additional $35,000 in construction costs for repairing or replacing the transformer. This may include procuring additional parts as well as labour for the work.

- It may take 24 hours for the operations team to relay the news to the maintenance team, for the maintenance team to ready their staff with repairs, for the engineering and management teams to review and approve the necessary work, and other indirect overheads. This could result in 24 hours of loss of production costs until the construction team begins their work.

- Facility has a capacity of 40,000 barrels per day

- There will be four wellpads and each of them average 10,000 barrels per day

- There will be one, non-redundant, 4160V/600V step-down transformer distributing power for each wellpad

We could lose ~$13,900 per hour = 10,000 bpd * ($101.32/bbl – $67.95/bbl) / 24 hours per day, in profit every hour until the transformer is fixed and the wellpad is operational again.

If we choose to repair the transformer, then we must also include the Mean Time To Repair (MTTR) the transformer as well as the time to begin the repairs: 411 hours = 387 hours + 24 hours.

If we choose to replace the transformer, then we must also include the Mean Time To Replace (MTTR) the transformer as well as the time to begin the replacement: 97.4 hours = 73.4 hours + 24 hours.

Assuming that we have a replacement transformer available to use, then the costs associated to replacing the transformer will be ~$1,390,000 = $35,000 + ($13,900 per hour * 97.4 hours). Since the number of failures per year for a liquid-filled transformer is 0.0041 times per year, then the cost we should spend to replace a transformer will be ~$5,700 per year = $1,390,000 * 0.0041 times per year.

Factoring $5,700 per year for costs associated to replacing one transformer may not amount to much especially when the cost to procure a transformer is already ~$80,000. However, once an economic analysis is done for each piece of equipment and then multiply this cost with the total quantity of the equipment, the costs can add up quite quickly.

It is important to note that the $5,700 per year assumes that this cost will be anticipated every year to replace one transformer for the next 244 years! For four wellpads, this annual replacement cost will be ~$22,800 = $5,700 for one transformer * 4 transformers. The actual cost if one transformer were to fail will be $1,390,000.

How much should be spent today to mitigate such a failure?

We will use time value of money with the following assumptions:

- Facility lifecycle = 30 years

- Discount rate of return = 10% per annum

- Discounted payment per year (ordinary annuity) to replace one transformer = $5,700

Once calculated, the present value of replacing one transformer is equal to $53,700. In other words, we should spend $53,700 today in capital costs to mitigate a future transformer failure. The $53,700 can be used to increase either the protection of the transformer or the frequency of maintenance. Spending the $53,700 today can theoretically reduce operating costs by $5,700 for the next 30 years for a total savings of ~$117,200 per transformer = ($5,700 per year * 30 years) – $53,700.